Four ways Embedded Financing will change FinTech and what it is

Every business may become a fintech company thanks to embedded finance, which is also opening up enormous economic opportunities.

When, when, and how consumers interact with financial products are altered by embedded finance, which also opens up significant opportunities for businesses in the financial and non-financial sectors. According to our analysis, financial services integrated into e-commerce and other software financing platforms made up $2.6 trillion, or over 5%, of all US financial transactions in 2021 and will surpass $7 trillion by 2026.

The definition of embedded finance, the various varieties of embedded finance, projections for industry development, and future trends will all be covered in this article.

Embedded Finance: What is it?

Non-financial businesses that offer financial goods and services are said to practice embedded finance. It might be a coffee shop app that supports 1-click payments, an online retailer that sells insurance, or a credit card that has the name of a department store.

Whether it’s a loan, payment plan, insurance policy, or another financial alternative, effective integrated finance solutions meet the client where they are.

The fact that embedded finance is a financial service provided outside of the conventional “going to the bank” environment is one of the major characteristics that define it. Instead of being a wholly independent aspect of a consumer’s life, embedded finance delivers financial services to the precise moment they are needed.

Some embedded financial services, such as credit cards for airlines, insurance for car rentals, and payment plans for expensive goods, have been available for some time. Now that e-commerce businesses are providing financial services directly on their sites rather than sending clients to a bank, embedded finance is gaining traction online. This phenomenon is made possible by third-party financing platforms and businesses that integrate financial services through APIs into non-financial enterprises’ user interfaces.

Online options, such as BNPL or POS financing services, which are integrated into practically all well-known and successful online retailers, are also growing in popularity.

Types of Embedded Finance

Products and services for embedded finance come in a wide variety. Depending on the sector and use scenario, they can differ considerably. The most popular integrated finance products include branded credit cards, banking, loans, insurance, consumer financing, and payments.

Embedded Banking

Embedded finance is occasionally used alternatively with the terms “embedded banking” and “banking as a service.” This is because the majority of embedded payment products, such as lending and payments, are frequently provided by banks. In this instance, we’ll define “embedded banking” as solely referring to bank accounts and the debit cards that go along with them, leaving other areas like transactions and loans to be considered as distinct sorts of embedded finance.

Non-financial businesses can provide their customers with a branded checking account to keep money and make payments in with embedded banking. For retailers or service providers who use a company’s platform to do business, embedded banking often makes the most sense. It probably provides quicker access to money and benefits that are only available to platform members.

The banks also began collaborating with financing platforms. A good example is Fortiva Retail Finance, which collaborates with ChargeAfter’s financing platform and makes use of its software to connect BNPL lending and POS financing for eCommerce retailers. By working together, the banks and the newly established and well-liked FinTech companies may provide the financing options that consumers on the market demand.

Another illustration is Shopify Balance, which enables store owners to “skip the bank” by receiving payments more quickly and avoiding the requirement to register a separate company bank account. Additionally, it provides a debit card with special benefits for expenditures made to expand a Shopify business.

Embedded Payments

When making a digital transaction, consumers may back out if they have to take out their credit card or enter it manually because of this friction. As there is no need for a card, embedded payments make the process simpler.

Embedded payments allow you to link and save a payment method for usage at a later time with only the click of a button. Many apps keep credit or debit card information to enable 1-click payments while awarding users with points for doing so.

Credit cards are just one type of embedded payment. While saving retailers money on fees, embedded payments can also provide customers the opportunity to pay directly through their bank accounts.

Branded Cards

Customers have long had access to credit cards for making purchases from their preferred brands. FinTech, however, has boosted the use of situations where it makes sense and enhanced the capacity of businesses to provide branded credit cards.

The B2B market is one place where branded card payments are having an influence. Companies have traditionally either given their workers personal credit cards to use for business costs or provided them with a company card from their bank. Both approaches have several drawbacks, such as having employees pay for business expenses out of their accounts or providing them with a corporate card that they may easily use to buy non-business products.

Businesses can now more easily obtain their company credit cards and provide them to their employee thanks to FinTech platforms. Compared to traditional banks, these platforms often speed up and simplify the sign-up process, provide more access to company credit, and let businesses produce as many branded business cards as they choose.

Any company that provides embedded banking must also be ready to provide branded debit cards to customers, staff, vendors, and even independent contractors.

Embedded Lending

Until embedded finance, a consumer who required credit to make a significant purchase had two options: use their credit card or obtain a regular loan from a financial institution, both of which carried high-interest rates. This has changed because embedded financing makes it possible for businesses to provide more appealing credit options at the moment of sale.

One of the most obvious and frequent examples of embedded finance that online shoppers see is “buy now, pay later.” Customers are looking at their available finances when going through the online checkout process. These products often offer interest-free monthly or weekly payment plans over a defined period. ChargeAfter, Affirm, and Afterpay are popular businesses that provide buy now, pay later options.

Embedded Insurance

Although embedded insurance has been available for some time, FinTech has aided its expansion to online markets. Embedded insurance is beneficial because it is available when consumers need it, without the need for a separate interaction with an insurance provider or agent—and, in certain cases, with several competing choices.

Companies may integrate digital insurance products in several ways, the majority of which involve collaborations with FinTech firms. These companies incorporate insurance alternatives into the checkout process, allowing customers to add insurance as an extra to their purchase.

The Growing Market of Embedded Finance

Consumers as well as enterprises and FinTech firms have a lot to gain from embedded finance. It offers users ways to save money and boost conveniences, such as incentives for using an e-commerce app from a certain company or zero-interest point-of-sale loans.

According to data, customers are open to using integrated financial services if doing so would benefit them. In the context of this, the embedded finance industry is predicted to grow strongly between 2022 and 2032, at a CAGR of 16.4%.

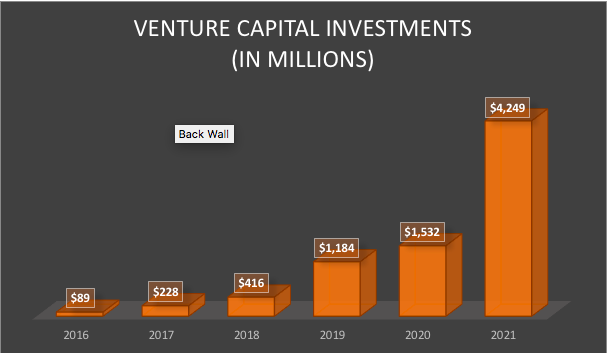

Investments in Embedded Finance 2016-2021

Embedded financial products from fintech companies are also flourishing. As the industry expands, embedded finance fintech businesses (such as those previously mentioned) are enjoying enormous gains in venture capital funding rounds. Investments in embedded finance made using venture capital tripled from 2020 to 2021. Dealroom estimates that by 2030, the embedded finance sector may be valued at over $7 trillion, which would be more than the total present value of all FinTech firms and the top 30 banks.

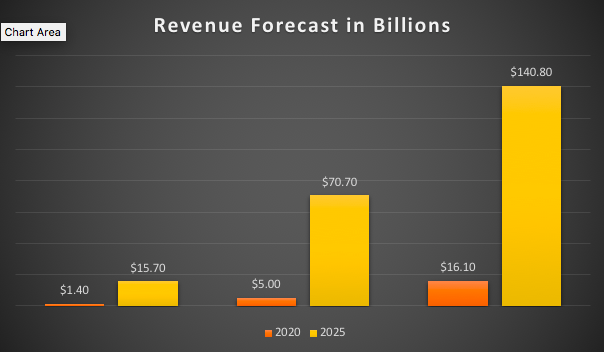

Numerous firms are trying to take advantage of the potential in a market where value is predicted to increase ten times between 2020 and 2025. Businesses, FinTechs, and financial companies will undoubtedly strive to take advantage of this expanding potential, and who benefits the most will depend on timing, execution, and market awareness.

Offering Embedded Financing

A non-financial corporation has three alternatives when offering a new financial service or product construct, partnering with, or purchasing. Build and purchase were the only choices before the development of embedded finance providers and FinTech, and they are far more costly and time-consuming than collaborating.

Partnerships are the foundation of the embedded financial revolution. To enable businesses to swiftly add on services like banking and payment cards, embedded finance providers handle the grunt work of forming alliances with banks and developing APIs. Then, rather than taking years to construct, they collaborate with non-financial enterprises (their clients) to get them up and running with these integrated finance goods and services in a matter of weeks or months. They are also far less expensive than purchasing a whole financial services organization.

Working with an embedded finance provider is usually the simpler choice when a non-financial firm decides it’s time to add checking accounts, loans, insurance, or another financial service.

The Future of Embedded Finance and Four ways it will change FinTech

Different forms of funding will undoubtedly become more popular in the future given the variety of embedded finance options already available. It also suggests that future advancements in embedded financial variants would enable many industries to provide customers with considerably better services.

We can claim with certainty that various financing choices for consumers are already growing better and more user-friendly. With the aid of financing services that are connected online or at nearby stores, you may now get the financing you need in seconds, which in the past took hours or even days.

Additionally, many finance platforms now provide a variety of possibilities. For instance, ChargeAfter’s multi-lender P2P platform has provided white-label BNPL services to merchants. In this way, the financing platform attracts more customers for its reputable lenders, and retailers or startup businesses who need to establish their brands or storefronts may now use the service and provide consumer finance to their clients under their brand names.

This is an illustration of how embedded funding is evolving. Let’s talk about four ways it may impact FinTech going forward.

1. Different relationships between financing platforms and consumers

Financial providers will need to get used to sharing consumers with non-financial firms for services that they previously only provided themselves as more businesses start operating as financial businesses.

The aforementioned illustration demonstrates that the process has already begun, and financial services like ChargeAfter are enabling businesses to manage customer relationships. Therefore, it is more likely to be true that non-financial aspects of finance, such as merchants and retailers, may have more influence in the future.

2. New Revenue Opportunities

Numerous new income streams have already been generated by integrating financial services into well-known customer journeys. As businesses continue to develop fresh and inventive methods of enhancing value through integrated finance, new income streams are probably to keep emerging.

We can see that the procedure is quick since, over the past few years, embedded financing has integrated itself into every online procedure. Various applications and websites incorporate financial elements. One excellent example of how embedded finance has given businesses new opportunities to incorporate new income streams is when a customer buys a ticket for travel and is presented with a variety of insurance alternatives at the point of sale.

3. New Competitions

Financial services organizations will need to rethink their business models as they compete for new markets as embedded financial services grow more common and more non-financial companies begin to enter these new markets.

Consumer financing is an instance where the procedure has already begun. We see how many finance platforms are introducing new features to enhance the funding process. The most effective technique for accelerating progress is competition. We can be certain that the competition is to “blame” for BNPL lending’s development as one of the most convenient forms of financing. In the end, it evolved into an interest-free financing alternative that the vast majority of consumers today choose.

4. New Partnerships

Brands and financial service providers will establish enduring (and extremely advantageous) alliances. Through these agreements, businesses will be able to offer embedded finance without having to hire entire teams of financial specialists and software engineers.

Financial services have never before had the chance to spread into previously non-financial sectors, and this possibility is still in its infancy. As more businesses use integrated finance and as customers get accustomed to these services, this financial transformation will spread stronger throughout almost all industries.

Banks are now beginning to collaborate with FinTechs, as is evident. Even large organizations like VISA and MasterCard have begun to benefit from various financing platforms to create better solutions for consumers. At the end of the day, the consumer is the one for whom these businesses are attempting to develop fresh concepts and offer improved services.

The moment to start developing is now for businesses that want to be a part of the revolution in integrated finance.

About ChargeAfter

ChargeAfter is a leading multi-lender platform for Buy Now pay later (BNPL) Consumer Financing. It connects businesses with the most reliable lenders, enabling them to offer customers the greatest financing solutions. With the best system of Waterfall Financing, ChargeAfter guarantees BNPL lending to every shopper, by matching the most relevant lender to every client. Using the unique consumer financing technology, ChargeAfter provides all parties, merchants, lenders, and consumers, with the best shopping experience. Phoenix, MUFG, VISA, Bradesco, BBVA, Synchrony, PICO Partners, CITI, Propel Venture Partners, Plug and Play, and other companies worldwide are among the investors of ChargeAfter.

Meta Description

Embedded finance is about to transform how FinTech operates and give customers new chances to employ various financing features. placed online

Tags: ChargeAfter, Buy Now Pay Later, BNPL, consumer financing, consumer finance, shop now pay later, payment plan, online BNPL, in-store, BNPL, BNPL white-label for banks, multi-lender BNPL, Point-of-sale, payment plan, split payments, get now, pay later, sales financing, BNPL lending, checkout finance